The Blueprint Tour: NYC brought together fintech and insurtech leaders…

for a day of expert panels, a high-energy pitch-off, and invaluable networking opportunities. From scaling strategies to funding insights, discover the key takeaways that are shaping the future of finance and insurance.

The Blueprint Tour: New York City united leaders from fintech and insurtech, along with investors and entrepreneurs. This event offered a dynamic day filled with insights, innovation, and networking opportunities. On February 13, 2025, the Classic Car Club in Manhattan hosted our event. Attendees enjoyed thought-provoking panels and a high-energy pitch-off. Valuable conversations took place, aiming to shape the future of finance and insurance.

Key Takeaways from The Blueprint Tour: NYC

From thought-provoking panels to an exciting pitch-off competition, the Blueprint Tour: New York City provided a deep dive into the challenges and opportunities shaping the fintech and insurtech industries. Attendees walked away with actionable insights on scaling businesses, securing funding, and fostering resilience in leadership. Below are the key highlights from each session.

Strategic Expansion – The How, When, and Why

The event kicked off with a powerful panel on strategic expansion, moderated by T Palmer (Founder and CEO, T Palmer Agency). Industry experts, including Grace Lee (AVP New Revenue, Great American Insurance Group), Veronica Genao (Executive Director, Technology Banking Group, Wells Fargo), and Marty Ringlein (Founder and CEO, Agree), explored the critical factors for fintech and insurtech startups looking to scale sustainably. Discussions centered around market timing, operational readiness, and leveraging strategic partnerships to drive expansion.

Key Topics Discussed:

Readiness:

- Key indicators signaling when a startup is ready to expand, including revenue stability, customer demand, and operational capacity.

- Assessing market readiness versus operational readiness to ensure a successful expansion strategy.

- Evaluating new markets and customer segments through competitive analysis and localized testing.

- Aligning expansion goals with the overall business strategy to avoid misalignment and unnecessary risks.

- Critical operational elements such as team structure, infrastructure, and scalable processes that must be in place before scaling.

Common Challenges:

- Common challenges startups face during expansion, including resource constraints, misaligned growth strategies, and regulatory hurdles.

- Balancing aggressive growth ambitions with sustainable operational practices to prevent financial strain.

- Overcoming hesitation around expansion due to concerns about losing control or compromising quality.

- A key takeaway: successful expansion requires careful planning, strong leadership, and adaptable execution.

Fintech vs. Insurtech Growth Startups Pitch-Off

The high-energy pitch-off was one of the most anticipated segments of the day. Startups in fintech and insurtech battled it out, showcasing their innovative solutions to a panel of expert judges, including David Gritz (Co-founder, Managing Director, InsurTech NY) and Abdul Abdirahman (Principal, F Prime Capital).

Startups that took the stage:

- Aviary AI – Jay Patel, Co-founder and CTO – A Voice AI-powered engagement tool for financial institutions, automating customer outreach and reducing human operator time. The company has seen a 42% pick-up rate and 71% interaction rate, proving its efficiency in customer communications.

- Tradesk Securities – Eric Chu, CEO – A fintech-powered broker-dealer providing AI-driven investment research tools for retail investors. With 23,000+ customers and 31 software patents, Tradesk is revolutionizing digital trading with real-time insights and zero-commission investing.

- Penelope – Jean Smart, Founder and CEO – A next-generation retirement savings platform designed for micro and small businesses, simplifying 401(k) plans with an intuitive, affordable, and automated approach. Penelope serves a diverse client base, with 42% minority-owned businesses and 61% women-owned businesses.

Pitch-Off Winner:

Jay Patel won the Pitch-Off with Aviary AI, showcasing the power of Voice AI in transforming customer engagement for financial institutions.

Masterclass: The Power of a Strong Brand Identity

Led by T Palmer, this masterclass provided attendees with a deep dive into how a strong brand identity can differentiate startups in the competitive fintech and insurtech landscapes.

Key Takeaways:

- A brand is more than just a logo—it’s about storytelling, identity, and customer connection.

- Consistency in messaging builds trust and credibility.

- Successful brands create movements, not just products, as seen with Apple, Nike, and Mailchimp.

- Emotional and behavioral triggers play a crucial role in shaping how customers perceive a brand.

Decoding Funding for Startups

A must-attend session for founders, this panel featured Cristina Ciaravalli (Founder and CEO, Valli Ventures), Jay Novis (Investment Associate, QBE Ventures), Adam Chadroff (Investor, Equal Ventures), and Anna Garcia (Founder and GP, Altari Ventures), who shared their expertise on securing funding in today’s market.

Key Topics Discussed:

Fundraising in Today’s Environment:

- The funding landscape for early-stage startups in 2025 remains competitive, with investors prioritizing sustainable growth over rapid scaling.

- Founders have multiple options to fundraise, including venture capital, angel investors, crowdfunding, and revenue-based financing.

- Balancing the need for funding with ownership retention remains a key challenge for founders, requiring careful negotiation and financial planning.

- Avoiding overfunding or underfunding is critical to ensure startups grow sustainably without unnecessary dilution or financial strain.

Path to Fundraising for Founders:

- Determining the right time to fundraise is dependent on achieving key milestones, such as product-market fit, revenue traction, or customer adoption.

- Investors look for specific metrics at different funding stages, from early traction and ARR growth to customer acquisition cost and lifetime value.

- Personal and professional networks play a significant role in securing funding, often leading to warm introductions to investors.

- Success stories from startups that navigated the funding process effectively emphasized the importance of persistence, strategic networking, and having a clear value proposition.

Tips & Tricks:

- Common mistakes startups make include pursuing funding too early without a validated product or waiting too long and missing market opportunities.

- Founders should develop a compelling pitch that highlights market opportunity, traction, and financial viability.

- Before engaging with investors, startups should refine their financial models and prepare to answer tough questions about growth, burn rate, and scalability.

Building Resilient Founders, Thriving Businesses

The final panel of the day addressed the importance of resilience in leadership and business. Panelists Ariel Laura Metayer (Founder, The Luminous Lab), Sharon Rodriguez (CEO, HighPeak.AI), and Kirsten Bay (Founder and CEO, Cysurance) explored strategies for maintaining founder well-being while scaling a company.

Key Topics Discussed:

Understanding Entrepreneurial Resilience:

- Resilience for founders means adapting to constant challenges while maintaining a long-term vision.

- Balancing work-life responsibilities is essential to prevent burnout and maintain productivity.

- Prioritizing physical health—through exercise, mindfulness, and rest—is crucial for sustained energy and decision-making.

- Ensuring business sustainability requires thoughtful financial planning, strong team culture, and adaptability.

Cultivating a Healthy Work Culture:

- Company culture plays a critical role in fostering resilience across the entire team, not just the founder.

- Implementing policies that promote physical and mental well-being positively impacts company performance and employee satisfaction.

- High-performance cultures should balance ambition with well-being to prevent burnout among employees.

- Leadership must set the tone for a workplace culture that prioritizes health, wellness, and overall team support.

The Power of Networking at The Blueprint Tour: NYC

Beyond the panels and pitch-offs, the Blueprint Tour emphasized networking as a key driver of success. The cocktail reception and Founders Dinner provided attendees with exclusive opportunities to connect with investors, industry leaders, and fellow entrepreneurs.

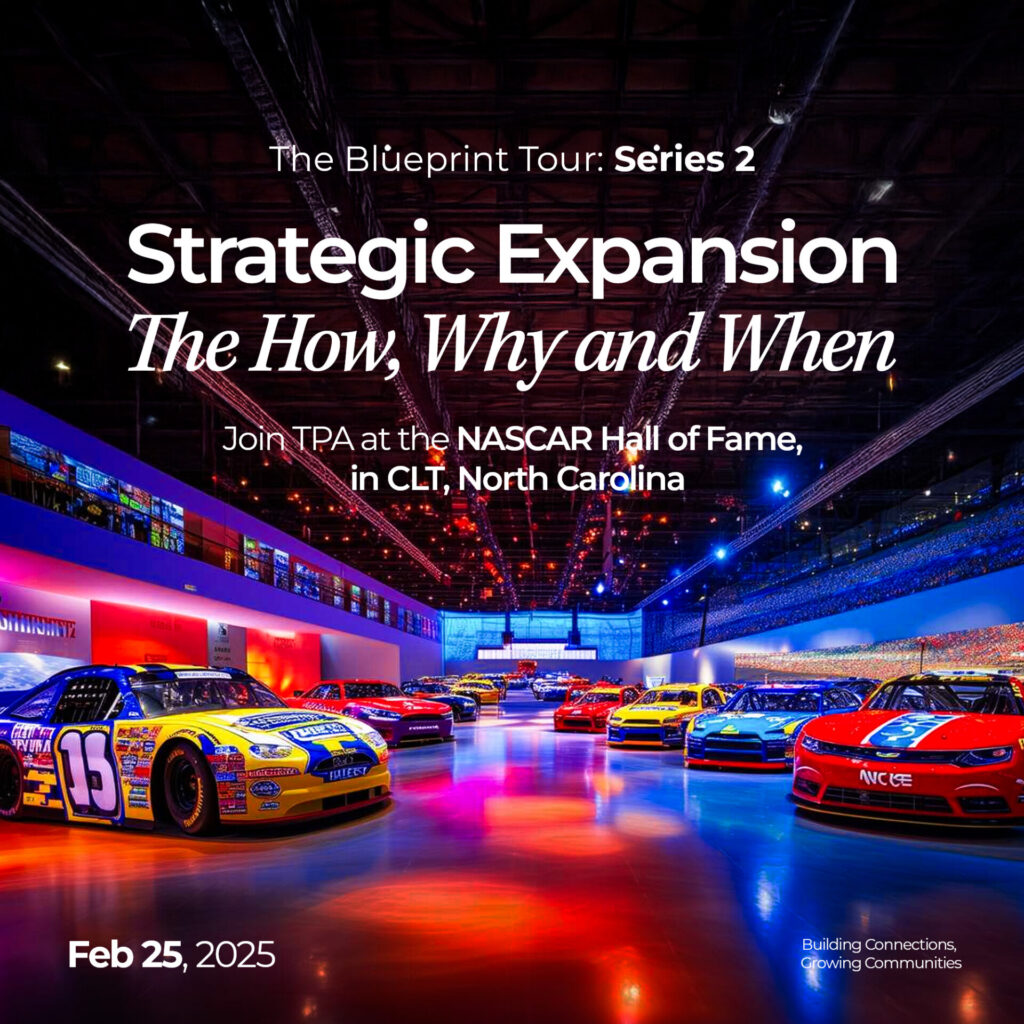

Looking Ahead: The Next Stop on The Blueprint Tour

NYC was just the beginning! The Blueprint Tour will be heading to new cities, continuing its mission to foster innovation and growth within fintech and insurtech.

📍 Next Stop: NASCAR Hall of Fame, Charlotte, NC on February 25th, 2025– Find more details here!

💡 Want to be part of the next Blueprint Tour event? Secure your spot today and connect with industry pioneers shaping the future of fintech and insurtech.

🔗 [Register for the Next Stop]