This article highlights the critical reasons fintech and insurtech startups fail, backed by failure statistics and real-world examples.

It also offers strategies to overcome challenges in funding, market fit, and regulatory compliance. Keywords: fintech failures, insurtech challenges, startup survival, fintech insights.

The world of fintech and insurtech startups is a thrilling ride. It’s a landscape filled with innovation, disruption, and potential for significant financial rewards.

However, it does involve certain risks.

The stark reality is that many of these startups fail. Understanding why they fail and the statistics behind these failures is crucial. It can provide valuable insights for founders, industry analysts, and journalists alike.

This article delves into the top 15 must-know fintech and insurtech startup failure statistics. It’s a comprehensive exploration of the challenges these startups face. It’s also a guide to navigating the complex terrain of financial and insurance technology.

We’ll look at the overall failure rates of startups. Start to examine the unique hurdles that fintech and insurtech startups must overcome. Finally, we’ll explore the reasons behind these failures, from lack of market fit to regulatory challenges.

We’ll also delve into the critical first year of operation. This period often determines whether a startup will survive or join the ranks of failed ventures.

Geographic and sector influences will also be discussed. We’ll consider how these factors can impact a startup’s success or failure.

The role of funding, particularly in the early stages, will be another key focus. We’ll look at how it can make or break a startup’s survival chances.

Finally, we’ll explore strategies for success. We’ll highlight the importance of innovation, customer experience, and strategic partnerships.

This article is not just about understanding the statistics. It’s about learning from them. It’s about using this knowledge to make informed decisions and strategies.

This article is for fintech startup founders, insurance industry analysts, and financial technology journalists alike.

It’s a deep dive into the dynamic world of fintech and insurtech startups.

Let’s begin by exploring the top 15 must-know fintech and insurtech startup failure statistics.

Understanding the Fintech and Insurtech Landscape

The fintech and insurtech sectors are rapidly evolving, driven by technological advancements and changing consumer behaviors. These industries are known for introducing innovative solutions that redefine financial and insurance services.

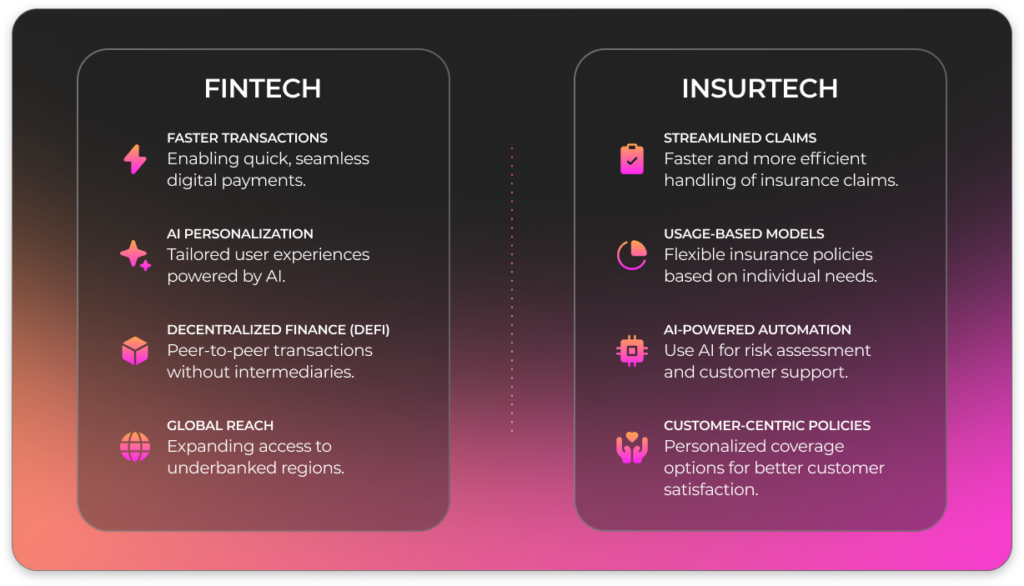

Fintech startups focus on enhancing financial transactions and services. They integrate technology into traditional finance, offering products that ease money management. Insurtech startups, in contrast, aim to revolutionize the insurance industry through technology.

The fintech industry is vast, covering areas like payments, lending, wealth management, and blockchain. Each sub-sector presents its own opportunities and challenges. Insurtechs often aim to streamline processes, improve customer experiences, and reduce costs within the insurance value chain.

The landscape is competitive and complex, attracting a mix of entrepreneurs, investors, and established firms. Startups must navigate regulatory environments, engage in strategic partnerships, and adopt cutting-edge technologies. Success requires staying ahead of regulatory changes and understanding market needs.

The synergy between fintech and insurtech is fostering a new era in financial services. As these startups push the boundaries of innovation, they also face unique obstacles. Addressing consumer demands and maintaining trust while managing technological and regulatory risks is crucial for these firms. The journey is challenging but offers immense growth potential for those who can effectively adapt and innovate.

The Stark Reality: Startup Failure Rates Across the Board

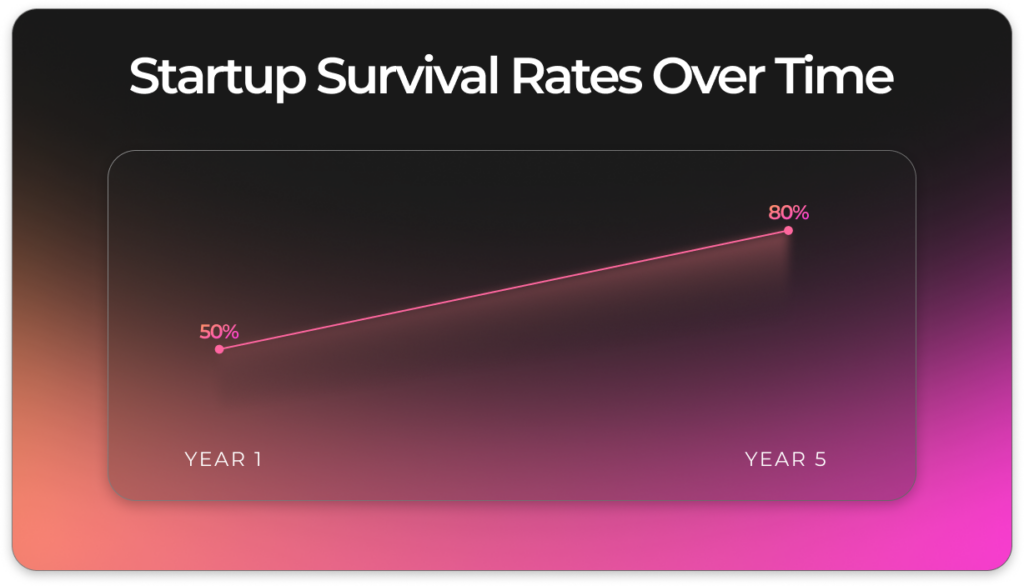

Startup failure is an undeniable reality. Studies show a grim picture: around 90% of startups do not survive. This high failure rate underscores the intense challenges faced by new ventures.

Failure rates vary across sectors. However, they often hover around similar benchmarks. Startups must tackle a range of obstacles, including market competition and financial constraints.

Specifically, around 20% of startups fail within their first year. This period is critical, as businesses strive to establish their presence and attract customers. By the fifth year, about 50% have succumbed to various challenges.

Several factors contribute to these high failure rates. Lack of market demand, poor management, and financial woes are common culprits. Additionally, failure to adapt to changes in consumer preferences can be detrimental.

Other significant issues include high operational costs and insufficient revenue generation. Startups often struggle with balancing expenditures against profits in their early stages. The following reasons are among the most cited:

- Lack of a strong value proposition

- Poor or ineffective marketing strategies

- Inability to scale the business model

- Weak team dynamics and leadership

- Misjudgment of customer needs or market size

The pressure to innovate and compete in a fast-paced environment is immense. Founders must be prepared for setbacks and be adaptable, as the road to success is rarely linear.

Fintech and Insurtech Specifics

In the fintech space, startups face distinct hurdles. Trust is a major issue, as consumers are cautious about financial services. Building a credible reputation is crucial for fintech startups.

Insurtech startups also encounter unique difficulties. Compliance with strict regulatory frameworks often poses a significant barrier. Navigating such frameworks requires substantial resources and expertise.

Both fintech and insurtech startups must invest in technological innovation. However, this also increases their exposure to cybersecurity threats. Protecting sensitive data while maintaining seamless operations is a constant challenge.

Finally, high customer acquisition costs further strain these startups. Competing with established firms for consumer attention and loyalty is an uphill battle. Understanding and addressing these specific challenges are key to navigating the competitive landscape of financial and insurance technology.

Top Reasons Why Fintech and Insurtech Startups Fail

Understanding the reasons behind fintech and insurtech startup failures is crucial. Each startup’s journey is unique, but common threads often emerge. These threads reveal deep-rooted challenges in the industry.

The absence of a strong product-market fit often tops the list. This occurs when startups fail to address genuine consumer needs. The market may be saturated, or the product may not resonate with potential users.

Another significant factor is financial mismanagement. Many startups run out of capital before they can secure sustainable revenue. High cash burn rates and unforeseen expenses can deplete resources rapidly.

Technological barriers also play a critical role in failures. Innovation is essential, but so is integration with existing systems. Many startups underestimate the complexity of this task.

Cybersecurity threats amplify these technological challenges. Breaches can erode trust, leading to a loss of customers and credibility. The sensitive nature of financial data demands robust protection measures.

Regulatory hurdles further complicate the landscape. Navigating complex regulations requires significant expertise and can be time-consuming. Non-compliance can lead to fines or shutdowns.

Operational inefficiencies contribute to downfall too. Poor management and lack of strategic planning can lead to missed opportunities. Founders need to wear many hats, and failing to prioritize can be detrimental.

Ultimately, the success or failure of a startup hinges on its ability to address these challenges. By understanding and preparing for these risks, startups can enhance their chances of survival.

Lack of Market Fit and Customer Acquisition Challenges

A common issue for fintech and insurtech startups is a lack of market fit. This occurs when a product fails to meet consumer needs. Understanding the target market is crucial to avoid this pitfall.

Customer acquisition presents another hurdle. The financial sector is crowded, making it difficult for new players to stand out. High costs of acquisition can drain resources quickly.

Many startups struggle to distinguish themselves from competitors. Without a unique value proposition, attracting loyal customers is challenging. This makes breaking into the market all the more difficult.

Effective marketing strategies can mitigate these challenges. Startups must be agile and responsive to consumer feedback. By doing so, they can refine their offerings and better serve their target audiences.

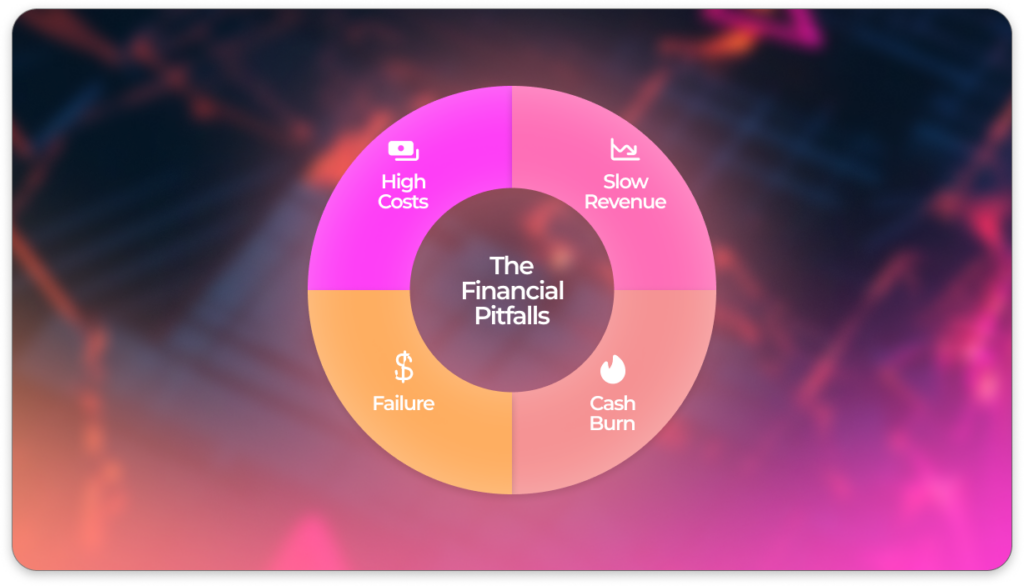

Capital and Cash Flow: The Financial Pitfalls

Financial mismanagement is a significant threat to startups. Many lack sufficient capital to sustain operations long-term. Cash flow management is critical but often overlooked in early stages.

Startups frequently run out of cash before achieving profitability. This is due to high operational costs and slow revenue growth. The need for ongoing funding is a constant pressure.

Securing investments is vital, yet challenging. Investors are cautious about high-risk ventures. Without adequate funding, startups may struggle to scale or even survive.

Cost control is essential to avoid financial pitfalls. Founders must balance spending against income. By maintaining financial discipline, startups improve their survival prospects.

Technological Hurdles and Cybersecurity Threats

Technology is both an enabler and a barrier for fintech and insurtech startups. Developing cutting-edge solutions is essential but fraught with challenges. Integration with existing systems can be complex and resource-intensive.

Startups often face high technical demands. Innovating requires significant expertise, which can be difficult to secure. Additionally, the rapid pace of technological change necessitates constant adaptation.

Cybersecurity threats pose serious risks to startups. Data breaches can lead to severe consequences, including loss of trust and legal issues. Protecting sensitive information is a top priority.

Implementing robust security measures is crucial for survival. Startups must prioritize cybersecurity from the outset. This involves both technological solutions and fostering a culture of awareness among employees.

Regulatory Challenges and Compliance Issues

Regulatory compliance is a major concern for fintech and insurtech startups. The industry is heavily regulated, requiring thorough understanding and adherence. Navigating this landscape demands expertise and resources.

Startups often underestimate the complexity of compliance. Regulatory requirements vary across regions and can change frequently. Staying compliant requires constant vigilance and adaptation.

Failure to comply can result in severe penalties or shutdowns. Non-compliance can damage reputation and erode customer trust. This makes regulatory strategy a critical aspect of business planning.

Collaborating with legal experts can help mitigate these risks. Building a solid understanding of the regulatory environment is essential. This enables startups to operate legally and ethically, securing their long-term success.

The First Year: A Critical Time for Fintech and Insurtech Startups

The first year for fintech and insurtech startups is pivotal. It’s a period filled with challenges and opportunities that can determine the future trajectory. During this time, founders must keenly focus on building a sustainable model.

Startups face many hurdles early on. Establishing a clear market presence is crucial but not easy. Founders must quickly demonstrate their product’s value.

In this initial phase, agility is an advantage. Startups need to iterate rapidly and adapt to market feedback. Flexibility allows them to pivot as necessary.

Despite the allure of innovation, attention to operational details is vital. Building a competent team and effective processes lays a strong foundation. Ignoring these aspects can lead to early missteps.

Several key elements influence survival during the first year:

- Product-Market Fit: Aligning the product with consumer needs.

- Capital Management: Efficiently utilizing available funds.

- Regulatory Compliance: Adhering to legal requirements.

- Technology Development: Ensuring robust and scalable systems.

- Customer Engagement: Building and maintaining user relationships.

Each factor interplays with others, underscoring the complexity of startup management in the fintech and insurtech sectors.

The Role of Funding in Early-Stage Survival

Securing funding early is paramount for startup survival. Fintech and insurtech ventures often require substantial capital to achieve their ambitions. This includes developing technology and acquiring customers.

The search for funding is a competitive endeavor. Investors seek viable, scalable models. It’s crucial for founders to articulate a clear vision to attract investment.

Many startups turn to venture capital for growth. However, this comes with pressures for rapid success. Founders must balance growth aspirations against maintaining long-term viability.

Efficient capital management can’t be overstated. Stretching each dollar can buy essential time for iterating and refining the product. This fiscal discipline sets the stage for sustained growth and eventual profitability.

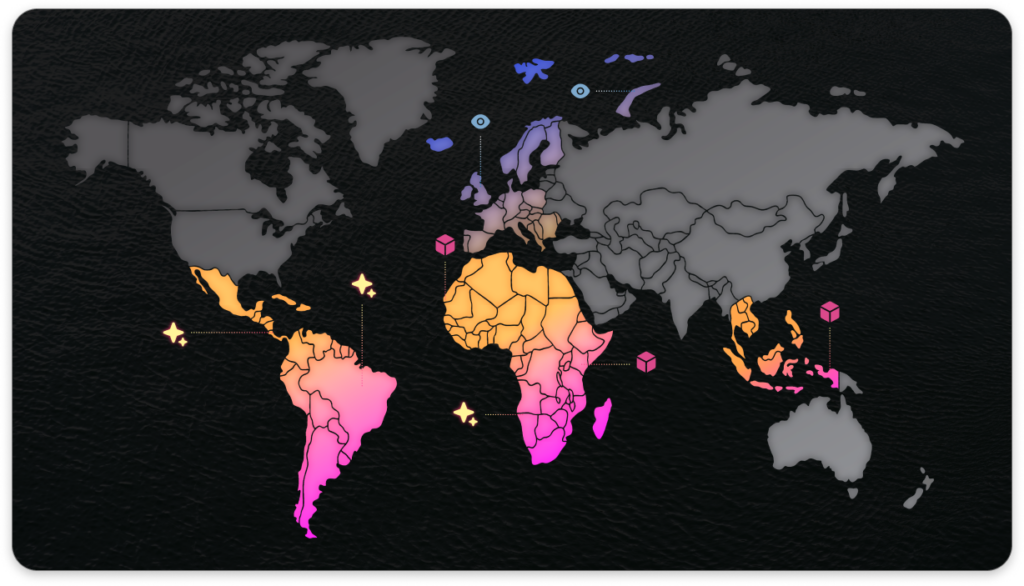

Geographic and Sector Influences on Startup Success

The success of fintech and insurtech startups varies across regions. Geography plays a significant role in shaping opportunities and challenges. Different markets have distinct regulatory environments, consumer behaviors, and levels of tech adoption.

Market maturity influences startup potential. In developed regions, competition is fierce but there’s easier access to advanced infrastructure and capital. Emerging markets, meanwhile, offer untapped potential but demand innovation amid infrastructure gaps.

Sector-specific factors also impact outcomes. Startups focused on payments or lending may face diverse hurdles compared to those in insurance or wealth management. Each sector has its own regulatory and operational complexities.

Understanding local market dynamics is crucial for startups aiming to expand globally. They must navigate cultural differences and adapt business models to new regulatory landscapes. This requires both strategic foresight and operational agility.

Key geographic and sector influences include:

- Regulatory Landscape: Varying legal requirements.

- Market Saturation: Competition levels in mature vs emerging markets.

- Cultural Preferences: Local consumer behaviors and expectations.

- Economic Conditions: Impact of regional economic health.

- Technological Infrastructure: Availability and accessibility of tech solutions.

Adapting to these factors empowers startups to better position themselves for success in diverse environments.

The Impact of the COVID-19 Pandemic

The COVID-19 pandemic reshaped global business landscapes. It accelerated digital adoption, influencing fintech and insurtech startups significantly. Many ventures saw increased demand for online financial services.

Startup resilience was tested. Those with robust digital platforms and remote capabilities thrived. Others had to quickly pivot to survive the new normal, adjusting strategies and operations to meet changing needs.

Despite these challenges, the pandemic presented opportunities for innovation. Startups that capitalized on emerging consumer needs found new growth avenues. This included services like contactless payments and telemedicine-powered insurance solutions.

However, not all weathered the storm equally. Some faced funding cutbacks and operational disruptions. The crisis emphasized the need for agility and preparedness in uncertain times, highlighting the importance of resilience in business strategy.

Strategies for Fintech and Insurtech Startup Success

Navigating the fintech and insurtech industries requires strategic planning. Success hinges on several key approaches that startups must adopt. These strategies ensure not just survival, but the potential for substantial growth and impact.

Firstly, understanding market needs is paramount. A deep dive into customer pain points informs product development. This helps in crafting solutions that resonate with target audiences, increasing the chances of market fit.

Secondly, financial prudence is essential. Efficient cash flow management extends runway, providing crucial time to iterate and refine offerings. Adopting a budget-conscious mindset also supports sustainable operations.

Collaboration is another vital strategy. Partnerships can unlock access to new markets, resources, and expertise. Engaging with established players in the financial ecosystem offers startups a competitive edge.

Key strategies include:

- Customer-Centric Approach: Prioritize user feedback.

- Efficient Cash Management: Monitor and control expenses.

- Strategic Partnerships: Collaborate with industry leaders.

- Agile Product Development: Rapid iteration for market needs.

- Regulatory Compliance: Stay abreast of changing laws.

- Technological Advancements: Embrace cutting-edge solutions.

By focusing on these strategies, startups can better position themselves to overcome common industry challenges and thrive in a competitive landscape.

Importance of Innovation and Customer Experience

Innovation sits at the heart of fintech and insurtech success. It’s more than introducing new products; it’s about reshaping how financial and insurance services are delivered. Startups must continually push boundaries to stay relevant.

Customer experience is equally crucial. An intuitive and engaging user interface differentiates a brand in a crowded marketplace. Providing seamless experiences builds trust and fosters loyalty among users.

Innovation and customer focus go hand in hand. By leveraging technology to enhance user interactions, startups can create memorable experiences that exceed expectations. This leads to higher satisfaction and retention rates.

Ultimately, prioritizing innovation and customer experience drives growth. It converts users into advocates, creating a ripple effect that amplifies brand presence.

Building Partnerships and Leveraging Technology

Building strong partnerships is a cornerstone for fintech and insurtech growth. Strategic alliances with banks, tech providers, and regulatory bodies offer startups much-needed leverage. These relationships can provide access to wider customer bases and advanced platforms.

Leveraging technology effectively is also vital. Startups should harness the power of AI, blockchain, and data analytics to streamline operations and enhance service offerings. This technological backbone supports scalability and efficiency.

Successful partnerships are mutually beneficial. They allow startups to focus on core competencies while partners fill gaps in expertise or reach. Together, they can tackle complex challenges and unlock new market opportunities.

In the rapidly evolving fintech landscape, collaboration and tech adoption set the stage for enduring success. Startups that capitalize on these strategies gain a robust platform to innovate and expand globally.

Looking Ahead: Trends and Predictions for Fintech and Insurtech Startups

The future of fintech and insurtech holds exciting possibilities. As these industries continue to mature, new trends are beginning to shape their trajectories. Understanding these shifts can help startups position themselves effectively in the evolving landscape.

One significant trend is the rise of embedded finance. Startups are integrating financial services into non-financial products, creating seamless user experiences. This approach is expected to redefine how consumers interact with financial services.

Sustainability is gaining traction within fintech. Consumers and investors are increasingly interested in companies with strong ESG (Environmental, Social, and Governance) practices. Startups focusing on financial wellness and sustainable solutions are likely to attract more attention.

Predictions for the coming years include:

- Rise of Embedded Finance: Integrating finance into everyday apps.

- Focus on Sustainability: Growing importance of ESG factors.

- Increased Personalization: Tailoring services to individual needs.

- Expansion of Digital Currencies: Wider acceptance of cryptocurrencies.

- Strengthening Cybersecurity Measures: Adapting to emerging threats.

Additionally, personalization is set to take center stage. Consumers prefer services tailored to their unique needs, pushing startups to offer more customized solutions. Leveraging data analytics and AI will be crucial for providing these personalized experiences.

With digital currencies gaining acceptance, startups must adapt to new forms of transactions and investment. This shift presents both challenges and opportunities for innovation.

Lastly, cybersecurity will remain a top priority. As technology advances, so do the threats. Startups need to invest in robust security measures to protect sensitive financial data, ensuring trust and compliance in their offerings.

Navigating the Fintech and Insurtech Ecosystem

Fintech and insurtech startups face a challenging yet rewarding path. Understanding the landscape and embracing innovation are crucial for their survival and growth. The unique hurdles they face, such as regulatory compliance and cybersecurity, require robust strategies and informed decision-making.

By leveraging emerging trends and focusing on customer-centric solutions, startups can carve out their niche in the market. Building strong partnerships, prioritizing user experience, and remaining adaptable to change will be key to navigating the complexities of the fintech and insurtech ecosystem. The journey is not easy, but with the right approach, success is within reach.

FAQs on Fintech and Insurtech Startup Failures

What is the typical failure rate for fintech and insurtech startups?

The failure rate for startups, in general, is high, with fintech and insurtech being no exception. Approximately 90% of startups do not succeed, with a significant number failing to reach their fifth year.

What Leads to the Failure of Fintech Startups?

Fintech startups often struggle with building trust, complying with regulations, and acquiring customers. The competitive market and integration complexities add further challenges.

Are insurtech startups more likely to fail than fintech startups?

Both face significant obstacles, but insurtech startups often contend with stricter regulatory environments. Balancing innovation with compliance is a common hurdle.

How does regulatory compliance impact startup success?

Navigating complex regulatory landscapes can drain resources and time. Startups that fail to comply risk penalties and business closure.

What role do market conditions play in startup failures?

Economic downturns and market saturation can hinder growth. Startups must adapt to these conditions to remain viable.

Is lack of funding a major reason for startup failures?

Yes, insufficient capital is a leading cause. Many startups run out of money before achieving profitability.

How can startups improve their survival chances?

By focusing on customer needs, securing adequate funding, and remaining flexible, startups can increase their likelihood of success.

What technology challenges do fintech startups face?

Fintech startups often deal with complex integrations and rapidly evolving tech trends. Staying updated with technology is vital.

Can partnerships help fintech and insurtech startups succeed?

Yes, strategic partnerships can provide resources, credibility, and access to new markets, enhancing the chances of success.

What advice is there for new fintech and insurtech entrepreneurs?

Be prepared for the hurdles ahead. Focusing on innovation, understanding customer needs, and staying compliant are essential steps.