As fintech and insurtech continue to redefine the financial services landscape, the question of how to scale sustainably in 2025 has never been more critical. With advances in AI, embedded finance, and blockchain driving the industries forward, companies must adopt strategic approaches to growth to stay competitive and deliver value.

This theme takes center stage at The Blueprint Tour NYC 2025, where the opening panel, “Strategic Expansion: The How, When, and Why,” will arm attendees with actionable strategies for sustainable scaling in a dynamic ecosystem.

What Is Strategic Expansion?

Strategic expansion involves more than just growing revenue or gaining market share. It’s about making informed, purposeful decisions that align with your startup’s capabilities and long-term goals. While rapid scaling can overwhelm infrastructure and strain resources, strategic expansion ensures growth is:

- Sustainable: Aligned with operational capacity and market demand

- Timely: Based on careful analysis of market readiness and industry trends

- Impactful: Focused on creating long-term value through meaningful relationships

Example in Action

Consider a fintech startup entering the Southeast Asian market. Without tailoring its product to local payment behaviors or forming partnerships with regional banks, it risks failing to resonate with users. By contrast, a company that prioritizes these steps positions itself as a trusted solution, increasing its chances of success.

At the NYC Blueprint Tour, experts from marketing, finance, insurance, and venture capital will explore these nuances, offering real-world advice during the opening panel discussion moderated by T Palmer.

Opportunities and Challenges in 2025

The fintech and insurtech sectors offer exciting opportunities but come with unique challenges. Understanding both is critical for founders aiming to expand strategically.

Opportunities

- Embedded Finance and Insurance: refers to the integration of financial services and insurance products into platforms that are not traditionally financial. This approach allows businesses to offer seamless financial solutions within their ecosystems, meeting customers where they already are. For example, a rideshare app offering insurance directly during the booking process creates a convenient, user-friendly experience that drives engagement. Such innovations are opening new customer bases and revolutionizing access to financial products in untapped markets.

- Technological Innovation: AI-Powered Insights are transforming how fintech and insurtech companies approach operations and customer engagement. Machine learning tools enable predictive analytics that can anticipate risks, streamline claims, and tailor personalized experiences. For instance, insurers can proactively detect fraudulent activities while offering bespoke policy recommendations to clients. This application of AI ensures better decision-making and fosters trust.

- Ecosystem Support: Venture capital firms, accelerators, and corporate partners are increasingly looking to collaborate with startups, providing funding, mentorship, and market access.

Challenges

- Regulatory Complexity: Expanding into new markets requires navigating diverse compliance requirements. For example, data privacy laws in Europe (GDPR) differ significantly from those in the U.S. (CCPA).

- Investor Expectations: In today’s funding environment, investors prioritize sustainable growth over flashy metrics. Startups need to demonstrate scalability without compromising financial or operational health.

- Operational Stress: Scaling too quickly can overwhelm infrastructure and teams, leading to inefficiencies or customer dissatisfaction.

At the NYC Blueprint Tour, these challenges will be unpacked in interactive sessions like the “Building Resilient Founders, Thriving Businesses, and a Prosperous Future” panel, moderated by T Palmer and featuring top-tier executives from Optimity, HighPeak, and Cy Insurance.

Why Strategic Expansion Matters

For startups looking to succeed in fintech and insurtech, strategic expansion is not just a growth strategy—it’s a survival strategy. Founders need to answer three critical questions:

- The How:

- How do you position your product to meet the needs of a new market?

- How do you secure funding to support your expansion?

- The When:

- When is the right time to expand?

- Are there early indicators that signal market readiness?

- The Why:

- Why does this market or opportunity align with your company’s mission and long-term goals?

These questions will serve as the foundation for discussions at the NYC event, providing attendees with actionable frameworks to apply to their own businesses.

Event Highlights: What to Expect

The NYC Blueprint Tour is more than just a conference—it’s a curated experience for fintech and insurtech leaders to learn, network, and grow.

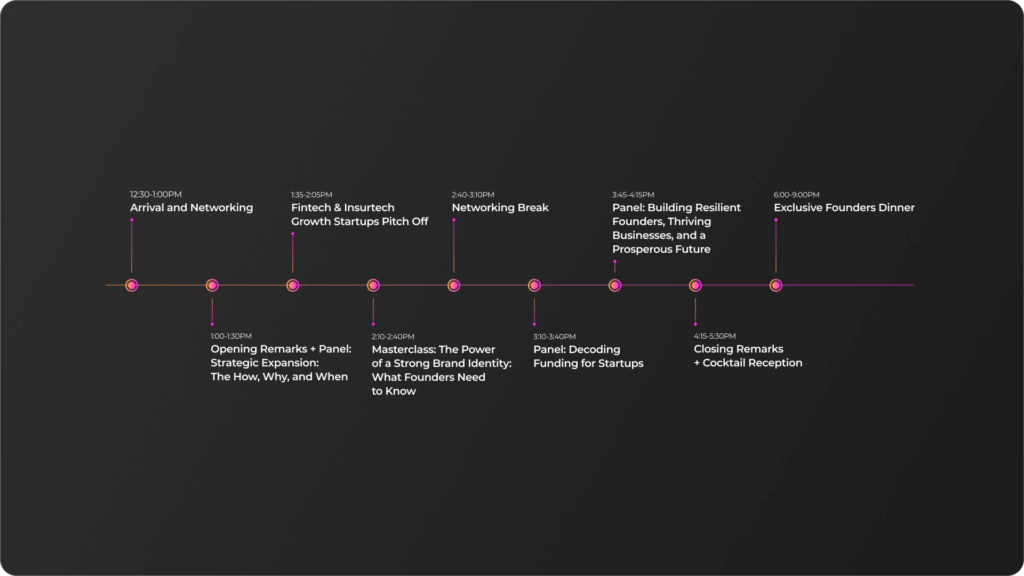

Key Agenda Items

Panel: Strategic Expansion – The How, When, and Why

Featuring a diverse group of experts, this session will provide perspectives from marketing, accounting, legal, and investment professionals, offering a comprehensive view of strategic scaling.

Fintech vs. Insurtech Growth Startups Pitch-Off

Witness four innovative startups—two from fintech and two from insurtech—compete in a high-stakes pitch-off. Each will have 6 minutes to present, followed by real-time feedback from seasoned investors.

Masterclass: The Power of a Strong Brand Identity

Led by T Palmer, this session will explore how branding can support growth by building trust and credibility in new markets.

Case Study: Resilience in Action

A fintech startup aiming to expand into Europe faced significant regulatory hurdles. By partnering with local banks to streamline compliance and leveraging their existing customer trust, the startup successfully entered the market while minimizing operational stress.

This approach exemplifies strategic expansion and will be explored in depth during the NYC Blueprint Tour.

Tips for Scaling Strategically

Understand Market Nuances: Research customer behaviors, competition, and regulatory landscapes before entering a new market

Build Operational Resilience: Ensure your team and infrastructure are equipped to handle increased demands

Leverage Partnerships: Collaborate with accelerators, corporate partners, and local organizations to ease market entry

Focus on Brand Building: A strong brand identity can differentiate your company and build trust with new customers

Join Us in NYC

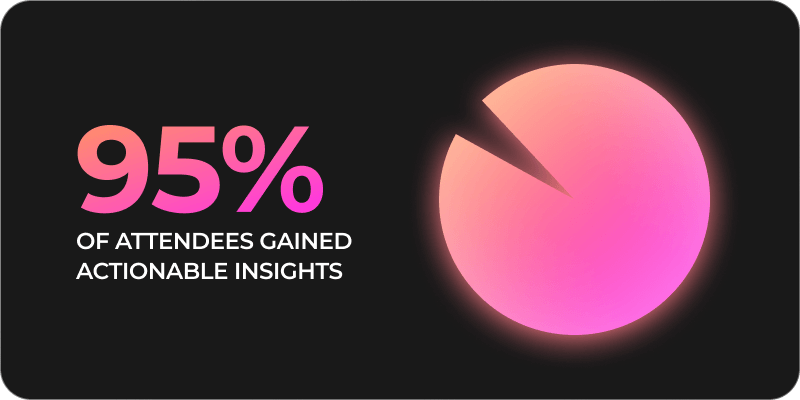

The NYC Blueprint Tour is your opportunity to gain actionable insights, connect with industry leaders, and position your company for sustainable growth.

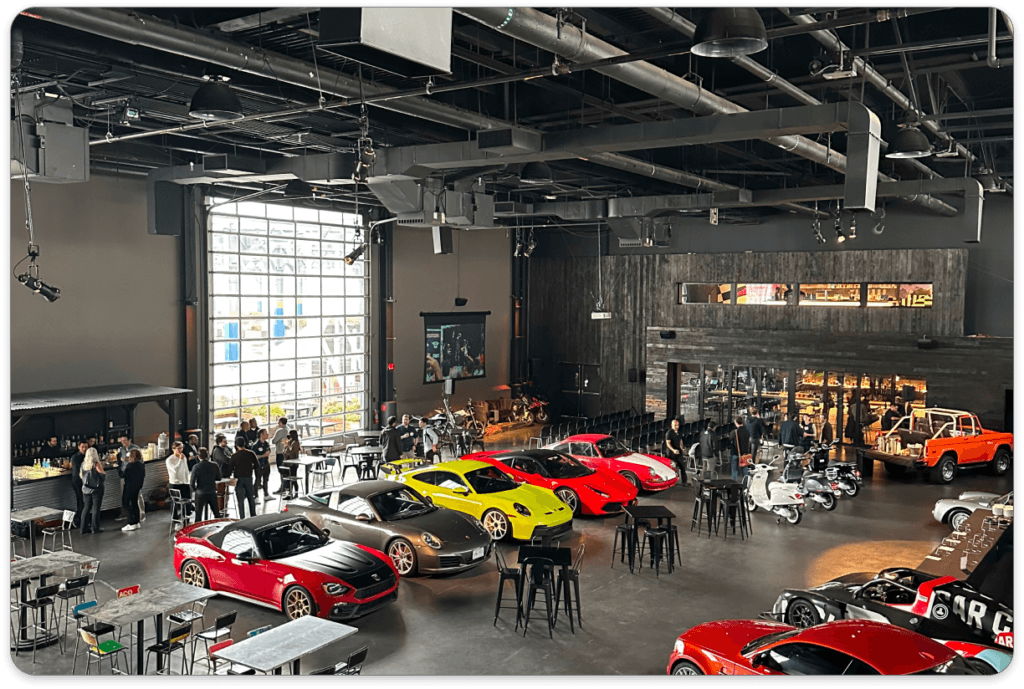

📅 Date: February 13, 2025

📍 Location: Classic Car Club, Manhattan

🕒 Time: 1:00 PM–6:00 PM

With limited seats available, this exclusive event is designed to foster meaningful connections and deliver high-value content. Register now to secure your spot and take your business to the next level.