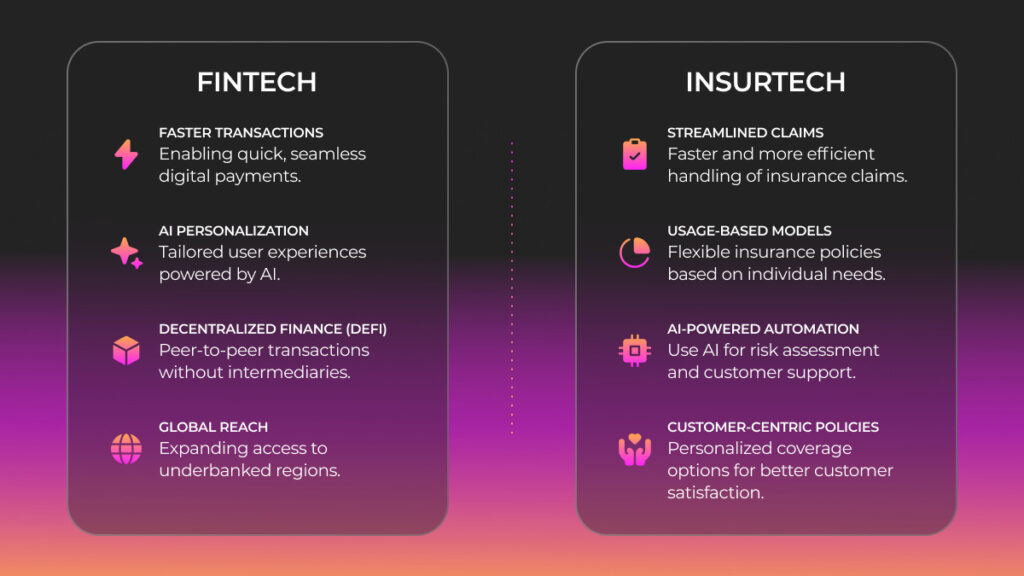

The Blueprint Tour San Francisco delivered high-impact discussions on fintech, insurtech, and healthtech.

With expert panels, a live startup pitch-off, and exclusive networking, the event fostered innovation and strategic expansion. Coverbase won the pitch-off with its AI-powered vendor management platform, while Wuuii showcased its AI-driven wildfire hazard assessment solution. Hosted by T Palmer Agency, a full-service marketing agency specializing in event marketing services, the event provided valuable insights for founders, investors, and industry leaders.

The Blueprint Tour San Francisco stop united the brightest minds in fintech, insurtech, and healthtech. This event fostered connections, sparked conversations, and showcased innovative startups in the industry’s changing landscape. Sponsored by JobsOhio, the event featured insightful panels on strategic growth and funding. It also included an intense pitch-off between fintech and insurtech. Attendees enjoyed thought-provoking discussions and gained actionable insights.

About JobsOhio

We were proud to have JobsOhio as our sponsor for the Blueprint Tour San Francisco. JobsOhio is dedicated to driving economic growth and innovation by supporting businesses and entrepreneurs in key industries, including fintech, insurtech, and healthtech. Their dedication to promoting innovation and investment aligns well with the Blueprint Tour’s mission. This initiative helps startups gain the resources, funding, and connections necessary for successful growth.

Key Highlights from the San Francisco Stop

Opening Panel: The Art of Strategic Expansion

The event began with the Strategic Expansion: The How, When, and Why panel. This session was moderated by Thien-Nga Palmer, the Founder and CEO of T Palmer Agency. Her agency is a full-service marketing firm that focuses on event marketing services. The discussion featured expert insights from:

- Ashlyn Lackey (Director, Innovation Strategy, Prudential) on navigating the challenges of scaling in the insurance sector.

- Eugenio González (Partner & Head of InsurTech, Plug and Play Ventures) on the role of accelerators in startup expansion.

- David Gritz (Co-Founder, Insurtech NY) on the financial services industry’s evolving investment landscape.

The conversation emphasized the importance of market readiness, strategic partnerships, and sustainable growth strategies for startups looking to expand.

Fintech vs. Insurtech Pitch-Off: A High-Stakes Showdown

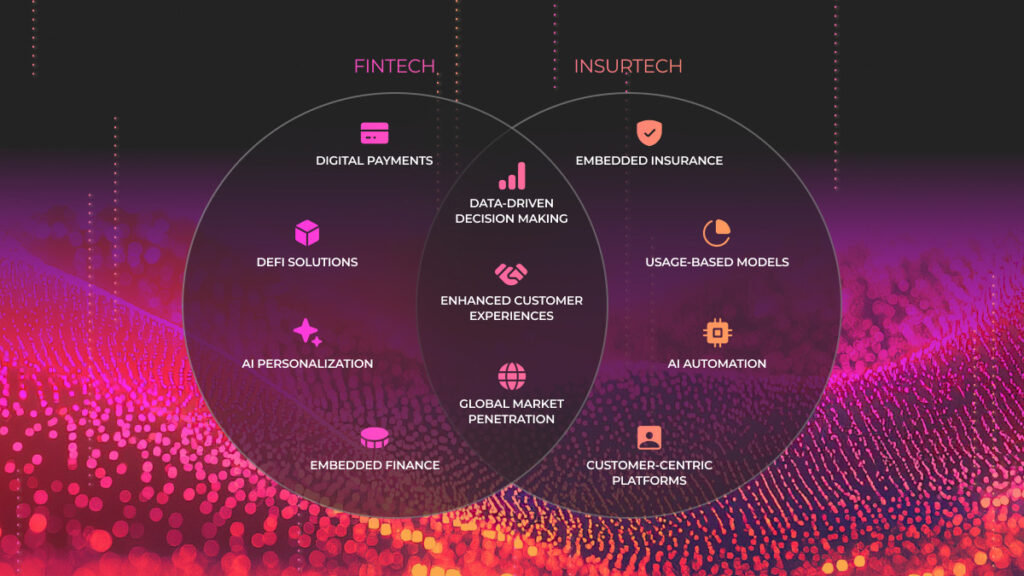

One of the event’s most awaited moments was the Fintech vs. Insurtech Growth Startups Pitch-Off. Here, early-stage companies showcased their innovations to a panel of respected judges. In just a few minutes, each startup made strong pitches. They received live feedback from investors and industry leaders.

🚀 Winner: Clarence Chio from Coverbase! After a series of impressive presentations, Coverbase emerged as the winner. It demonstrated its potential to transform the fintech and insurtech sectors with its AI-powered vendor management platform. By optimizing workflows and streamlining operations, Coverbase enhances efficiency and scalability for businesses navigating the any ecosystem.

Other participating startups included PartnerSpace, a platform that simplifies embedded and affiliate partnerships. Another notable participant was Wuuii, which is transforming digital insurance solutions through AI-driven personalization.

Masterclass: The Power of a Strong Brand Identity

Branding isn’t just about logos and taglines—it’s about storytelling, trust, and market positioning. Led by Thien-Nga Palmer, this masterclass explored how founders can build a compelling brand that stands out in a competitive landscape. Attendees gained insights into crafting a brand narrative that resonates with customers and investors alike.

Decoding Funding for Startups: VC Perspectives

Securing funding is one of the most pressing challenges for fintech, insurtech, and healthtech founders. In the Decoding Funding for Startups panel, Suzanne Passalacqua (Managing Director, Carrick Capital), Sarah Kim (Partner, Centana Growth Partners), and Tanvi Lal (VC, Intuit Ventures) shared their expertise on what investors look for, how to structure fundraising efforts, and the key financial metrics that drive investment decisions.

Building Resilient Founders & Thriving Businesses

The day wrapped up with a candid discussion on resilience and sustainability in entrepreneurship. Eric Schneider (Founder & CEO, Akko), Jason Andrew (COO/CIO & Co-Founder, Zoe Foundry), and Hannah Wu (Co-founder & CEO, Amplify Life Insurance) shared their experiences in navigating the ups and downs of startup life, emphasizing the importance of mental well-being, adaptability, and long-term vision.

A Night of Networking and New Opportunities

Following an action-packed day at Stem Kitchen & Garden, attendees gathered for an exclusive cocktail reception. Conversations flowed over drinks, while live music created a vibrant atmosphere. The Founders Dinner later in the evening offered a cozy atmosphere for meaningful conversations. It helped build valuable connections among founders, investors, and industry leaders.

What’s Next?

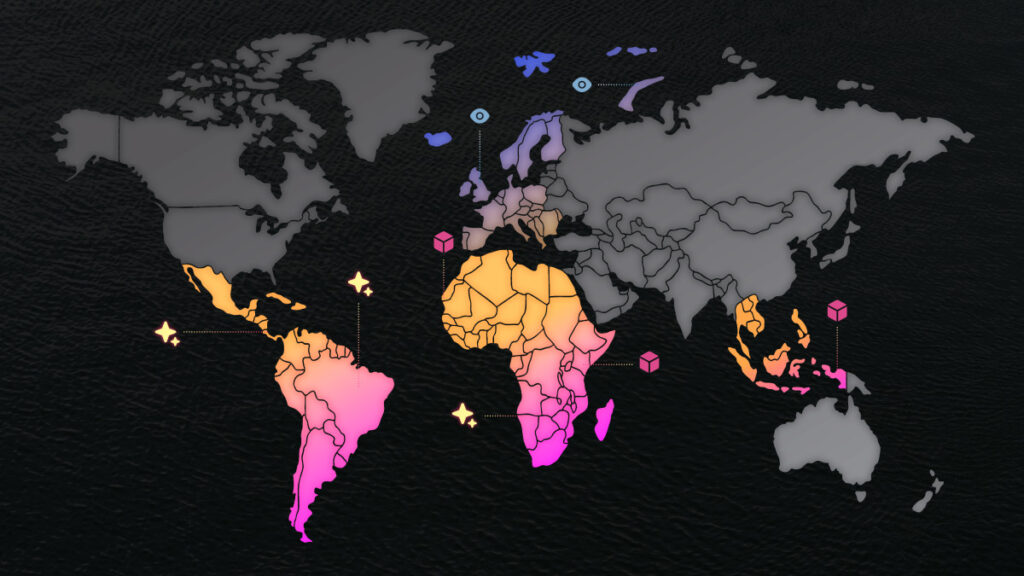

As the Blueprint Tour progresses through key hubs in fintech, insurtech, and healthtech, we can feel the energy from San Francisco. This excitement sets the stage for our upcoming stops. Whether you’re a founder looking for funding, an investor scouting the next big thing, or an industry leader eager to share insights, the Blueprint Tour is the place to be.

📍 Looking to host an unforgettable industry event? Our team specializes in crafting high-impact experiences that drive meaningful connections. From marketing services to full-service event marketing strategies, we help businesses create experiences that leave a lasting impact. Learn more about our event services today!